The Week in Geek™ – Feb. 15, 2012

How Facebook’s IPO Stacks Up Against Google

Facebook is finally going public – ticker symbol: FB, exchange (NYSE or Nasdaq): to-be-determined, lead underwriter: Morgan Stanley. And it’ll be the largest IPO in tech history. Facebook is initially filing to raise $5 billion (and that could go up). For comparison, Google’s $1.7 billion ’04 IPO held the previous record for largest IPO by a US Internet firm. Some suggest Facebook’s post-IPO value will top $100 billion. Likely a good bet if, as currently-planned, only 5-7% of shares float and hype fuels the demand fire.

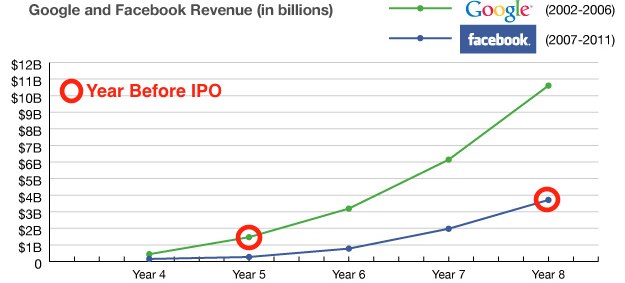

So how do Facebook & Google compare? Facebook is going public as an 8 year-old – Google went public after 5 yrs. Pre-IPO Facebook revenues are $3.7 billion, about 2.5x the $1.5 billion in revenues of pre-IPO Google. Facebook brought in $1 billion in profits last year, about 10x Google’s pre-IPO profit of $106 million. And Facebook’s post-IPO market cap is currently estimated to be between $85-$100 billion, around 4x Google’s post-IPO value of $23 billion. But the comparison isn’t Apples-to-Apples (no pun intended). Roll the clock back & 5 year old Facebook (roughly the age of GOOG at IPO) actually lost $56 million on revenues of just $272 million. Google as an eight year old brought in $10.6 billion in revenue and $3.5 billion in profits, and sported a market cap of over $150 billion. The 8-year old comparison also isn’t quite a fair one since capital raised during the IPO & a secondary offering helped fuel Google growth over those three years, but still, 8 yr. old Google made about as much profit as 8 year old Facebook did in revenue. As TechCrunch points out the 5-year compound annual growth rate for each firm’s revenue during comparable periods (2002-2006 for Google, and 2007-2011 for Facebook) was almost exactly the same: 89% a year. I put together the table below for easy side-by-side comparison:

If you’ve been working for Zuck for a couple of years or more, then you’re probably golden (or about to be). Facebook’s IPO is expected to create between 500 and 1,000 millionaires – roughly 1/3 the firm’s workforce. Among the Facebook investors that will cash out – Bono. The rocker/activist is a partner in VC firm Elevation Partners and his share of the firm’s take from a public Facebook may earn him well north of what he’s made during his entire career as U2’s front man. However, if Elevation is like most VCs, it’ll give 80% of its Facebook stake upside back to limited partners (the institutions it raised its fund from), and it’ll then split up the remaining 20% among Elevation’s team. That means Bono’s take is almost certainly quite a bit less than the widely reported $1 billion.

COMMENTARY: So is Facebook worth it? Advertisers in the United States alone spent $36 billion to reach online audiences in 2011, up from $26 billion in 2010. Facebook currently brings in about $4.39 per user (useful acronym – ARPU for ‘average revenue per user). For comparison, Google’s ARPU is above $30 (there’s also a nice ARPU comparison chart in the Facebook chapter of my book that I’ve recreated below). 85% of Facebook revenue comes from advertising, about 15% from online payments, and just one firm, Zynga, is responsible for about 12% of Facebook’s revenue (Zynga CEO Mark Pincus owns about .5% of Facebook – not a bad post-IPO haul after taking ZNGA public last year). Facebook keeps 30 cents of every dollar users spend on Facebook credits, and game firms like Zynga have to use Facebook’s currency.

Facebook nation has swollen to 845 million monthly users. More than half visit each day, spending about 20 minutes a day on Zuckerberg’s site. Mobile is a huge growth area, with 425 million people using Facebook’s mobile app on all major smartphone systems. But it’s also currently a major challenge since, according to Facebook’s filing, the firm “has not yet developed any meaningful stream of revenue from mobile advertising or other mobile products“. Here’s more concern: new growth in emerging economies is far less valuable than past growth. Consider that Indonesia is a “Top 3” nation by Facebook use, but most of these consumers access via mobile (many via text-based non-smartphones). That means this massive customer base earns the firm almost no money. Moore’s Law will make phones more robust & open up more revenue opportunity, but lifetime customer value for high-income nations doesn’t necessarily mean the same can be expected in the short-term from Facebook’s emerging markets march. Also – China (about 1/5th of the world’s population) still remains out of Zuck’s grasp.

Bechmark VC Bill Gurley offers a compelling argument as to “Why Facebook Belongs in the 10x Revenue Club“. The underlying strategic factors are covered in depth in the Facebook chapter of my book. But surprising in discussions of Facebook’s value – few mention the potential of two items: An ad network and Facebook TV. An ad network seems obvious given that ads outside of Google-owned sites generate 30% of Google revenue. Advertisers should like Facebook’s ad-targeting rifle-scope. Consider that a Facebook campaign aimed at adults between the ages of 25 and 49 “had a 95% accuracy, compared to the industry average of 72%.” More accurate ads should be a magnet for both advertisers, as well as content sites that are often paid based on ad performance (e.g. PPC, targeted impressions served). Longer term, what about Facebook TV? Netflix CEO Reed Hastings is on Facebook’s board – imagine a Facebook social platform being baked into hundreds of consumer electronics products just as Netflix is today. There could be a “Like” from your remote with the potential for Facebook to: deliver targeted video ads, offer up questionnaires, become a middleman for living room media consumption, generate revenue from on-demand streaming, act as a subscription gate keeper, gather massive amounts of targeting data, and more.

As my TechTrek students know, those visiting Facebook’s new digs (the firm’s third new HQ in three years) will see a sign that says “this journey is 1% finished.” Look for an exciting 99% in the years ahead. If you want to be a part of that journey, you can buy facebook shares uk by following the link and investing in the company.

All Hail Emperor Zuckerberg Mark Zuckerberg initially controlled 3 of 5 board seats. He could do this because he could demand the terms – his firm grew fast (network effects), the demographic of Facebook users was hugely attractive, and he didn’t need that much capital to get started (big chunks of Facebook are based on open-source software). All that meant he could demand more favorable terms from the VCs that fell over themselves to fund subsequent rounds of private investment. Now it seems even publicly traded Facebook will have Zuckerberg’s authority firmly cemented. Slate states: “When it goes public, Facebook will be conducting an experiment in corporate dictatorship nearly without precedent for such a large and high-profile company.”

Mark Zuckerberg initially controlled 3 of 5 board seats. He could do this because he could demand the terms – his firm grew fast (network effects), the demographic of Facebook users was hugely attractive, and he didn’t need that much capital to get started (big chunks of Facebook are based on open-source software). All that meant he could demand more favorable terms from the VCs that fell over themselves to fund subsequent rounds of private investment. Now it seems even publicly traded Facebook will have Zuckerberg’s authority firmly cemented. Slate states: “When it goes public, Facebook will be conducting an experiment in corporate dictatorship nearly without precedent for such a large and high-profile company.”

Mark Zuckerberg will own 28% of post-IPO Facebook. That’s a huge chunk when you consider that the largest shareholder in Exxon Mobile (mutual fund giant Vanguard) holds only 4.19% of that firm. But Facebook also has two shares of stock – Class A shares, and Class B shares. The latter have 10 times the voting rights of the former. Zuck’s Class B shares (along with proxies he controls) give him voting rights that amount to 57% of firm control. Bill Gates had less than 50% of post-IPO Microsoft, and Apple’s five largest shareholders aren’t the Jobs Estate, they’re institutions (mutual funds and hedge funds). The deal isn’t entirely without precedent. Together Sergey and Larry control the majority of Google voting rights, but the Google Duo claim they’ll cede majority rights by 2014.

Zuck’s control may actually increase over time. This is because if the relatively few owners of non-Zuckerberg Class B shares sell their stock, they transform into Class A shares with 1/10th the voting rights. Class B insiders cash out? Zuck’s degree of control goes up! There’s even an estate planning clause where Zuckerberg’s Class B shares can be transferred to a person or entity designated as his successor. As Slate says “absolutely nothing-up to and including death-is going to dislodge Zuckerberg from control of his firm.”

Amazon’s Performance: A Mixed Bag There is a stellar new infographic on Amazon’s massive growth and impact. (example, Amazon has 5x the unique user traffic as eBay, with web sales that are 5x Wal-Mart.com, Target.com, and Buy.com COMBINED). Amazon’s Q4 revenue rose to $17.43 billion, up 35%. That’s killer growth for a retailer in a down economy, but about a billion (with a ‘b’) short of what analysts were hoping for. Profits were down sharply from a year ago, too (the money-losing Kindle no-doubt contributing), but unlike the revenue shortfall, the profit drop was less steep than expected. Lower performance aside, that still puts Amazon’s annual growth at a staggering 47% vs. the still respectable 15% for all of U.S. e-commerce. Again we see Internet dynamics in ways that seem to defy the rule of large numbers – the big get bigger, faster! Amazon also warned that it might lose $100 mil to $200 mil in the current quarter. That guidance hurts, but the firm is still trading at a lofty P/E that hovers near 135.

There is a stellar new infographic on Amazon’s massive growth and impact. (example, Amazon has 5x the unique user traffic as eBay, with web sales that are 5x Wal-Mart.com, Target.com, and Buy.com COMBINED). Amazon’s Q4 revenue rose to $17.43 billion, up 35%. That’s killer growth for a retailer in a down economy, but about a billion (with a ‘b’) short of what analysts were hoping for. Profits were down sharply from a year ago, too (the money-losing Kindle no-doubt contributing), but unlike the revenue shortfall, the profit drop was less steep than expected. Lower performance aside, that still puts Amazon’s annual growth at a staggering 47% vs. the still respectable 15% for all of U.S. e-commerce. Again we see Internet dynamics in ways that seem to defy the rule of large numbers – the big get bigger, faster! Amazon also warned that it might lose $100 mil to $200 mil in the current quarter. That guidance hurts, but the firm is still trading at a lofty P/E that hovers near 135.

E-commerce only makes up about 5% of all U.S. retail spending, so Amazon expects lots of growth and is building accordingly. The firm currently has 69 warehouses worldwide, and it added eleven new fulfillment centers in 2011. Nomura Securities estimates that Amazon will add the equivalent of 450 Costco stores from 2011 to 2016. To put that in perspective, Costco, itself has just 592 stores worldwide.

The only specifics on the Kindle shared by Amazon stated Q4 sales were up 177% over the prior year. Analysts estimate as many as six million Kindle Fires plus “millions more” traditional Kindles were sold. For comparison, Apple’s quarterly freak-show-of-growth claimed 15 million iPads sold over the holiday quarter. More perspective – Amazon’s operating margins are 1.3% while Apple’s are about 30%. One last curiosity in the most recent Amazon financials – the daily deals site & Groupon competitor LivingSocial lost $558 million on revenues of $245 million in 2011 (AMZN owns 31% of LivingSocial).

Amazon Wants to Burn the Book Business BusinessWeek serves up a provocative cover story chock full of tasty nuggets of disruption (a great class read & great fodder as I write an Amazon chapter for the next edition of my book). Consider that overall U.S, sales of paperbacks and hardcovers fell 18% between 2010 and 2011, the former #2 chain, Borders, is gone, and most remaining booksellers are struggling. Amazon, however, is still the clear leading player in both e-books and print, and today sells 105 e-books for every 100 dead-tree titles. Nearly 30% of all Americans claim to own at least one digital reading device – a market where the Kindle is king. Amazon is a sales juggernaut, but now Amazon might also be an unstoppable competitor to big publishing houses. Amazon’s success may be good for many; Slate recently ran a provocative story that stated “Buying books on Amazon is better for authors, better for the economy, and better for you.”

BusinessWeek serves up a provocative cover story chock full of tasty nuggets of disruption (a great class read & great fodder as I write an Amazon chapter for the next edition of my book). Consider that overall U.S, sales of paperbacks and hardcovers fell 18% between 2010 and 2011, the former #2 chain, Borders, is gone, and most remaining booksellers are struggling. Amazon, however, is still the clear leading player in both e-books and print, and today sells 105 e-books for every 100 dead-tree titles. Nearly 30% of all Americans claim to own at least one digital reading device – a market where the Kindle is king. Amazon is a sales juggernaut, but now Amazon might also be an unstoppable competitor to big publishing houses. Amazon’s success may be good for many; Slate recently ran a provocative story that stated “Buying books on Amazon is better for authors, better for the economy, and better for you.”

Think like a strategist – what does the move to become a publisher get Amazon? Exclusive content, the ability to capture middleman (publisher) revenue that it can pass on to authors as higher royalties and customers as lower book prices. Plus no other retailer manages inventory as efficiently as Bezos – cutting out much of the loss in unsold shelf-stock that is the bane of both publisher & bookseller operating costs.

Forrester estimates that traditional publishers offer authors roughly 20% royalties (on avg. publishers take 50%, booksellers 30%). With Amazon Publishing authors will get 45-50% of the selling price. And with “almost infinitely deep pockets for spending on advances to top authors,” expect Amazon to pony up for content. As an example, Amazon’s publishing arm recently spent $800,000 for the rights to the memoir of actress/director Penny Marshall. As one insider put it, “Publishers are selling drinks on the Titanic. They are doing so much to protect their paper industry that they are disregarding the needs of customers and are treating authors poorly.” Another quoted in PandoDaily is even more blunt: “Long-term there’s no future in printed books“.

Publishing is an industry that’s already an oligopoly, with the majority of bestsellers controlled by the “Big Six”- Random House, Simon & Schuster, HarperCollins, Penguin, Hachette, and Macmillan). And five of the “Big Six” are currently being investigated for eBook price-fixing. Look for more tensions among “frenemies” that are both partners and rivals. Barnes and Noble and other chains are refusing to carry print versions of titles from Amazon Publishing. Barnes and Noble also pulled 100 DC Comics graphic novels after DC offered Amazon an exclusive for its comics, bypassing the Nook. Several publishers are refusing to participate in library e-book lending programs, prompting protests from the American Library Association. Amazon offers customers of its Amazon Prime two-day-shipping service a one-book-at-a-time free lending download, and initial feedback suggests the program actually increases not just buzz, but overall sales of participating titles (yet another benefit to authors). One last shocker – Amazon seems to be preparing to open its first-ever physical store in Seattle. Suspect something more akin to a Kindle-centric Apple Store clone than a Costco-sized big box.

Let the Robot Drive I can’t drive (poor vision), and while it’s still unclear if I’ll have a robo-chauffer during my lifetime, Wired’s cover story on self-driving cars offers hope to all. Driving is dangerous and it takes up time. Human errors are implicated in 93% of automobile crashes and the average American commutes 52 minutes each day. Those are huge improvement opportunities to target. Says Anthony Levandowski of Google’s self-driving-car project “The fact that you’re still driving is a bug, not a feature“.

I can’t drive (poor vision), and while it’s still unclear if I’ll have a robo-chauffer during my lifetime, Wired’s cover story on self-driving cars offers hope to all. Driving is dangerous and it takes up time. Human errors are implicated in 93% of automobile crashes and the average American commutes 52 minutes each day. Those are huge improvement opportunities to target. Says Anthony Levandowski of Google’s self-driving-car project “The fact that you’re still driving is a bug, not a feature“.

Fears of catastrophic software crashes, four-wheel viruses, and other nightmare scenarios will likely make it quite some time before we can let go of the wheel and grab the Kindle and coffee, but the building blocks of self-driving cars are already being baked into the devices in showrooms and garages. Today’s premium-class automobiles run 100 million lines of computer code, more than Boeing’s new 787 Dreamliner. Mainstream commercial motor vehicles can parallel park themselves, drive under cruise control, warn drivers when they’re at risk for collision, take control of braking, among other things (all that tech also means that auto-industry IP lawsuits are on the rise, too).

The self-driving car is really about big-data. It’s “hack-driving”. The car constantly gathers inputs, mines the dataset that is the road & its environment, and algorithms perform AI-based machine-learning to constantly improve performance. Google isn’t so much “teaching” its computers how to drive as it is letting the patterns reveal themselves as cars drive 200,000 road miles (and climbing). Mercedes is building pedestrian-recognition software based on over 1.5 million samples of real and “virtual” people. Going global also requires cultural tweaks. In Germany, a Mercedes can alert drivers to the presence of speed limit signs contained within a quite-detectable red circle. In U.S., however, square signs can look a lot like billboards or buildings, generating all sorts of false positives. We’ll also have to re-write the law. In 2011, Google helped Nevada draft the first legislation to allow autonomous cars to hit the state’s roads. But in most states it’s not clear who’d get the ticket for any robo-driving mishaps.

The “connected car” can also lead to new and creative revenue models. If airbnb can turn any house or apartment into a rentable property (5 million nights booked so far), RelayRides will allow you to “pull an Avis” and turn your car into a cash-generating rental asset. Sound farfetched? GM has inked a partnership with RelayRides. The firm’s OnStar system can even be used to allow customers to unlock vehicles and eliminate the need to exchange keys. See the Wired article above for cool video, photos, & interactive graphics.

OpenTable’s rise and fall is a cautionary tale Fortune’s coverage of online reservation firm OpenTable’s 2011 performance is a good read for b-school students, covering several issues including industry competitiveness and market expectations. OpenTable went public in May 2009 and consistently delivered, beating analyst estimates by a wide margin, quarter after quarter. The stock hit $118 in April of last year, and as a Net stock with post-IPO performance & upward momentum, it likely helped contribute to demand for many of last year’s Internet IPOs including LinkedIn, Pandora, Groupon, and Zynga. But over the next 8 months OPEN gave back about 2/3 of its value – trading around $39 when this Fortune piece was written. As the magazine points out, when a stock loses two-thirds of its value that quickly it’s usually a sign of a terrible misstep, scandal, or financial collapse. That’s not the case here. OpenTable is still in heavy growth mode – revenue is expected to swell 40% in 2012, and operating margins are a healthy 17%.

Fortune’s coverage of online reservation firm OpenTable’s 2011 performance is a good read for b-school students, covering several issues including industry competitiveness and market expectations. OpenTable went public in May 2009 and consistently delivered, beating analyst estimates by a wide margin, quarter after quarter. The stock hit $118 in April of last year, and as a Net stock with post-IPO performance & upward momentum, it likely helped contribute to demand for many of last year’s Internet IPOs including LinkedIn, Pandora, Groupon, and Zynga. But over the next 8 months OPEN gave back about 2/3 of its value – trading around $39 when this Fortune piece was written. As the magazine points out, when a stock loses two-thirds of its value that quickly it’s usually a sign of a terrible misstep, scandal, or financial collapse. That’s not the case here. OpenTable is still in heavy growth mode – revenue is expected to swell 40% in 2012, and operating margins are a healthy 17%.

So what happened? In part, we saw a correction. Momentum investors pushed the stock to the point where it was trading at a PE well above 100 (compared with the historical market overall average PE of around 15 – about where Apple trades today). Side note: while many cite Netflix’s summer-to-fall missteps as the primary reason NFLX dropped, it’s also important to note that this summer, Netflix was also sporting a nosebleed triple-digit PE before the pricing fumble. Stocks priced for perfection risk a looming reality – nobody’s perfect.

The May departure of OpenTables CEO for VC firm Andreessen Horowitz likely contributed to the stock slide. Another concern for OpenTable is competition from credible rivals. Europe’s Eveve online reservation system claims to have nabbed 20% of OpenTable’s bookings during a four-month Minnesota-invasion. Europe’s Livebookings also smells opportunities in the U.S., and offers free reservations along with premium analytics & e-mail marketing. OpenTable may still have a great business. Network effects, brand, and the switching costs all created by its early-mover status may give it a sustainable edge. But the future is uncertain enough to have smacked the “momo” cheerleaders back to a reasonably priced reality. Key lessons to remember as market improvements and new IPOs seem likely.

The Cloud Goes Hollywood![]() DVD sales peaked at $15.5 billion in 2004, but they’ve been cratering ever since, down roughly 20% during the first half of last year. Meanwhile streaming and kiosk sales were up over 40% in the same period. And the takedown of Megaupload shows piracy lingers, even on a celebrity-endorsed site.

DVD sales peaked at $15.5 billion in 2004, but they’ve been cratering ever since, down roughly 20% during the first half of last year. Meanwhile streaming and kiosk sales were up over 40% in the same period. And the takedown of Megaupload shows piracy lingers, even on a celebrity-endorsed site.

In an effort to extend the lucrative DVD buying window, Warner Bros is doubling the time that Netflix and Redbox need to wait to receive DVDs from 28 days after discs go on sale to 56 days. Redbox says it’ll fight back, acquiring Warner DVDs via ‘alternate means’. HBO has also said it will stop selling discount discs to Netflix DVD-by-mail business, and it continues to refuse to provide its original titles to Netflix or other streaming sites. Hollywood realizes its future is in access-anywhere digital, so it has finally stepped into the cloud, but in a way that encourages higher revenue ‘ownership’ rather than subscription streaming or rentals. UltraViolet is a standard that stores purchased content on remote servers that can then be streamed to different devices as long as you can verify your purchase. Many new DVD and Blu-ray titles come with Ultraviolet digital rights, and some 750,000 households in the U.S. and Britain have already set up UltraViolet accounts. With Fox expected to announce UltraViolet support, soon, that’d leave Disney as the lone big-studio holdout. Disney backs its own effort called KeyChest, and the studio’s ties with Apple also remain tight. The Steve Jobs estate remains Disney’s largest shareholder, a result of the firm’s purchase of Jobs’ Pixar.

In its current form, UltraViolet lacks polish. Customers first create an UltraViolet account. To watch movies they then need to log into Flixster, a movie site operated by Warner Bros. But expect UltraViolet bundling to become standard, soon. Blu-ray is almost certainly the last physical media format used for mass-market sales. Viva la Cloud!

Netflix Bounces Back, but Says Amazon is Coming Analysts expected Netflix to earn 54 cents a share last quarter – the firm actually came in at 73 cents a share. Subscribers were also up 600k for the quarter. The firm ended the year with 24.4 million U.S. subscribers, up 25% from the previous year. Not bad despite the Qwikster debacle. The current subscriber breakdown is as follows:

Analysts expected Netflix to earn 54 cents a share last quarter – the firm actually came in at 73 cents a share. Subscribers were also up 600k for the quarter. The firm ended the year with 24.4 million U.S. subscribers, up 25% from the previous year. Not bad despite the Qwikster debacle. The current subscriber breakdown is as follows:

- Domestic streaming: 22 million subscribers

- Domestic DVD: 11.17 million subscribers

- International: 1.86 million subscribers

Still, the firm warned it may lose money in 2012 as streaming costs soar. Netflix is also seeing stepped up competition. Amazon cut a deal with Viacom so that Amazon Prime customers will now be able to stream shows from Viacom networks MTV, Comedy Central, Nickelodeon, TV Land, Spike, VH1, BET, CMT and Logo. Amazon says it now offers some 15,000 streaming titles vs. about 20,000 that stream over Netflix. Verizon and kiosk-firm Redbox also plan a streaming venture later this year.

WePay Grows Revenue 10x in 2011, Plans Mobile App Kudos to my former student Bill Clerico and his BC co-founder Rich Aberman on completing a killer year. The duo was named to BusinessWeek’s “Best Young Tech Entrepreneurs” list, and their online payments firm, WePay (the ‘banker’ for Occupy Wall Street and now cited as a legitimate PayPal competitor) grew ten fold last year, and is now processing several million dollars in payments each month. The firm’s API allows the WePay engine to power payments beneath the hood on other sites (like GoFundMe, which replaced PayPal with WePay last year), and new WePay services like ticket sales and stores have greatly expanded on the firm’s original peer-to-peer payments base. While the firm’s compound monthly growth rate of 30% is impressive, look for even more revenue rocket fuel as the firm expands into mobile payments this year. The photos below show Clerico lecturing to my students at the firm’s Palo Alto HQ on January’s TechTrek, and Aberman speaking at the BC Presidential Scholars dinner earlier this month. WePay’s brain trust also includes two other former TechTrek students of mine – Clerico’s classmate, Tyler Gaffney (a GE vet and sales god), and Sophie Monroe (a brainiac who could have graduated in just 3 years, yet decamped before earning her sheepskin to build the firm’s widely praised service team). Keep at it, folks, we’re hugely proud of you!

Kudos to my former student Bill Clerico and his BC co-founder Rich Aberman on completing a killer year. The duo was named to BusinessWeek’s “Best Young Tech Entrepreneurs” list, and their online payments firm, WePay (the ‘banker’ for Occupy Wall Street and now cited as a legitimate PayPal competitor) grew ten fold last year, and is now processing several million dollars in payments each month. The firm’s API allows the WePay engine to power payments beneath the hood on other sites (like GoFundMe, which replaced PayPal with WePay last year), and new WePay services like ticket sales and stores have greatly expanded on the firm’s original peer-to-peer payments base. While the firm’s compound monthly growth rate of 30% is impressive, look for even more revenue rocket fuel as the firm expands into mobile payments this year. The photos below show Clerico lecturing to my students at the firm’s Palo Alto HQ on January’s TechTrek, and Aberman speaking at the BC Presidential Scholars dinner earlier this month. WePay’s brain trust also includes two other former TechTrek students of mine – Clerico’s classmate, Tyler Gaffney (a GE vet and sales god), and Sophie Monroe (a brainiac who could have graduated in just 3 years, yet decamped before earning her sheepskin to build the firm’s widely praised service team). Keep at it, folks, we’re hugely proud of you!

The Other Side of Open Textbooks (A Conversation with a Bald Man)![]() Apple is all-in on textbooks and the effort will be spectacular for iPad-only environments. MIT is also offering a free online course, and Rice is in the game, too. But it’s nice to see our efforts get a little bit of coverage (we’ve been sharing content online for well over a decade, and my free-in-browser open text is in its fifth edition). I hope this interview is useful for anyone considering either writing or adopting an open-source textbook. Continued thanks to all for helping spread the word about my text. Also thanks to MBAPrograms.org for naming me one of the “Top 50 Business School Professors to Follow on Twitter“.

Apple is all-in on textbooks and the effort will be spectacular for iPad-only environments. MIT is also offering a free online course, and Rice is in the game, too. But it’s nice to see our efforts get a little bit of coverage (we’ve been sharing content online for well over a decade, and my free-in-browser open text is in its fifth edition). I hope this interview is useful for anyone considering either writing or adopting an open-source textbook. Continued thanks to all for helping spread the word about my text. Also thanks to MBAPrograms.org for naming me one of the “Top 50 Business School Professors to Follow on Twitter“.